Introduction

If you're involved in international trade, you're likely familiar with the complex world of shipping terms. One of the most commonly used Incoterms (International Commercial Terms) is CIF, but many people still wonder about the actual CIF meaning in shipping. Whether you're an importer trying to minimize hassle or an exporter ensuring your goods arrive safely, understanding CIF can significantly impact your operations, cost, and responsibilities.

In this guide, we’ll break down everything you need to know about CIF—what it stands for, how it works, its advantages and disadvantages, and how it compares to other Incoterms. Let's get started.

What Does CIF Mean in Shipping?

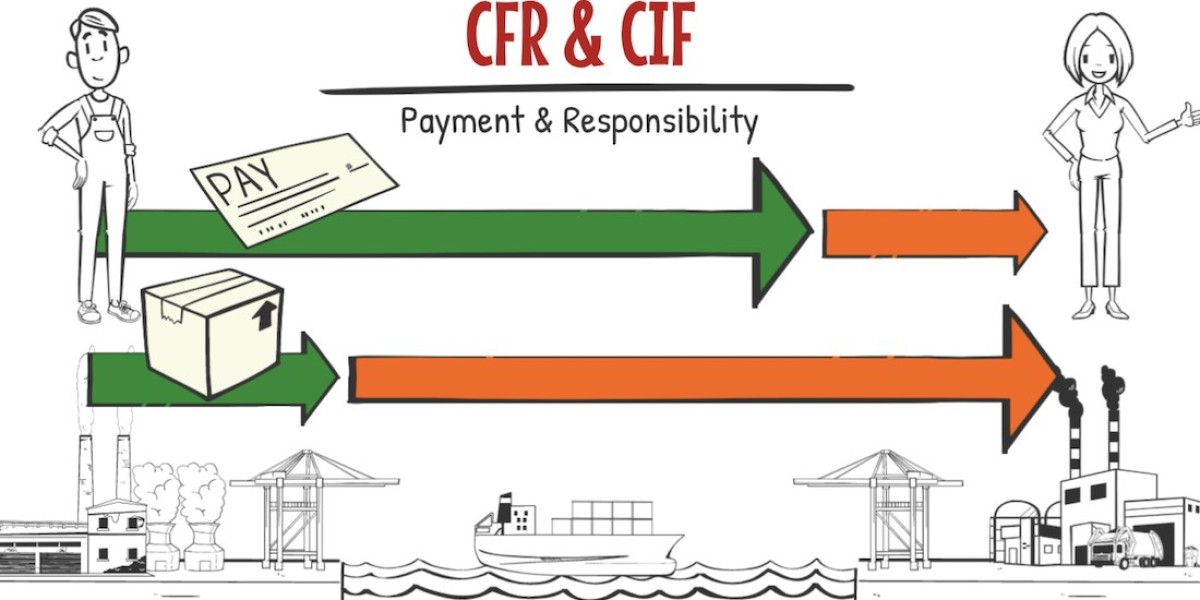

CIF stands for Cost, Insurance, and Freight. It’s a shipping agreement under Incoterms where the seller is responsible for arranging and paying for the transportation of goods to the port of destination, including insurance. However, once the goods are loaded on the shipping vessel, the risk transfers to the buyer.

To put it simply, under CIF:

The seller covers costs of goods, marine insurance, and freight charges up to the buyer’s port.

The buyer takes over responsibility and risk once the goods are on board the ship at the port of origin.

Key Components of CIF

Understanding the CIF meaning in shipping requires a breakdown of its three main elements:

1. Cost

This includes the price of the goods and any costs associated with transporting them to the port of shipment and loading them onto the vessel.

2. Insurance

The seller is obligated to purchase marine insurance to protect the cargo during transit. This coverage is typically minimal (Clause C of the Institute Cargo Clauses) unless otherwise agreed upon.

3. Freight

The seller pays for the freight to transport the goods to the destination port. However, unloading and further inland transport are the buyer’s responsibility.

When to Use CIF in Shipping

CIF is mainly used in sea or inland waterway transport, and it’s particularly useful when:

The seller has better access to shipping carriers and insurance.

The buyer prefers convenience and doesn’t want to manage shipping logistics.

Goods are high-volume or heavy cargo, like commodities or bulk materials.

It’s a popular choice in industries such as oil & gas, construction materials, textiles, and food products.

CIF vs Other Shipping Terms

There are several Incoterms available, and it's important to understand how CIF compares to others, especially FOB (Free on Board).

| Term | Who Pays for Freight | Who Arranges Insurance | Risk Transfers |

|---|---|---|---|

| CIF | Seller | Seller | Onboard ship |

| FOB | Buyer | Buyer | Onboard ship |

| EXW | Buyer | Buyer | At seller's door |

| DDP | Seller | Seller | At buyer's door |

In FOB, the buyer takes care of shipping and insurance, while in CIF, the seller handles it—making CIF more buyer-friendly for those new to international logistics.

Advantages of Using CIF

CIF has several benefits for both sellers and buyers, depending on the situation.

For Buyers:

Less Hassle: The seller handles most of the logistics.

Insurance Included: Basic cargo insurance is included in the cost.

Cost Transparency: The price usually includes all shipping-related expenses up to the port.

For Sellers:

Control Over Logistics: Sellers can manage shipment schedules and choose freight forwarders.

Better Bargaining: Sellers often get better deals on freight and insurance due to higher volumes.

Disadvantages of CIF

Despite its convenience, CIF also comes with a few downsides:

For Buyers:

Limited Insurance Coverage: The seller may opt for the cheapest policy, which may not be adequate.

Lack of Control: Buyers can’t choose the freight company or shipping schedule.

Higher Costs: Sometimes, sellers add a premium for the convenience they offer.

For Sellers:

Added Responsibility: More effort required to coordinate shipping and insurance.

Potential Liability: Risk of claims and delays during transit until goods are loaded on the ship.

Common Mistakes to Avoid with CIF

To ensure smooth shipping under CIF terms, avoid these pitfalls:

Not verifying insurance coverage: Always confirm what type of marine insurance is included.

Assuming door-to-door delivery: CIF ends at the port of destination, not the final delivery location.

Mixing up with similar Incoterms: Don’t confuse CIF with CIP (Carriage and Insurance Paid To), which applies to all transport modes.

Real-World Example

Let’s say a seller in China is shipping 10,000 units of electronics to a buyer in Nigeria using CIF. Here's how it works:

The seller arranges shipping with a freight forwarder.

They pay the cost to get the goods to the Port of Lagos, including basic insurance.

Once the goods are loaded onto the vessel in Shanghai, the risk shifts to the Nigerian buyer.

If the goods are damaged at sea, the buyer makes a claim under the seller’s insurance.

It’s a straightforward process—if both parties understand their roles.

CIF in the Modern Supply Chain

In today’s digital age, CIF is evolving with tech-driven platforms and logistics tools. Digital freight forwarders offer real-time visibility, e-documents, and instant quotes, which help buyers and sellers manage CIF shipments more transparently and efficiently.

Moreover, regulatory changes in 2025 are pushing for stricter documentation and insurance transparency, making it even more critical to understand what’s included in your CIF deal.

CIF Insurance: What You Should Know

One of the most overlooked aspects of CIF is insurance. According to Incoterms, the seller must only provide minimum coverage. This may not be enough for high-value or fragile goods.

As a buyer:

Ask for Clause A coverage instead of Clause C.

Review the insurance certificate carefully.

Consider buying additional insurance if the value of your cargo warrants it.

When CIF is Not Ideal

There are scenarios where CIF may not be the best choice:

Landlocked countries: CIF only covers up to the port—if your final destination is far inland, another Incoterm may be better.

Customs complexity: If local customs procedures are complicated, having control over shipping (like under FOB) might help.

When you want full control over logistics: Some businesses prefer managing their own shipping for quality assurance.

Best Practices for CIF Shipments

To make the most of CIF, follow these tips:

Get everything in writing: Include CIF terms in your sales contract and specify insurance details.

Use a reliable freight forwarder: A good agent ensures timely shipping and accurate documentation.

Track your shipment: Use digital tools to stay informed throughout the transit.

Budget for port fees: Remember, CIF doesn’t include import duties or terminal charges.

Conclusion

Understanding the CIF meaning in shipping is essential for anyone involved in global trade. As one of the most commonly used Incoterms, CIF offers a balance between convenience and responsibility. While it simplifies the shipping process for buyers, it also demands careful planning, especially regarding insurance and risk management.

Whether you’re a seasoned exporter or new to importing, knowing when and how to use CIF can save you time, money, and unnecessary headaches. As the world of logistics continues to evolve in 2025 and beyond, mastering CIF shipping could give your business a competitive edge.