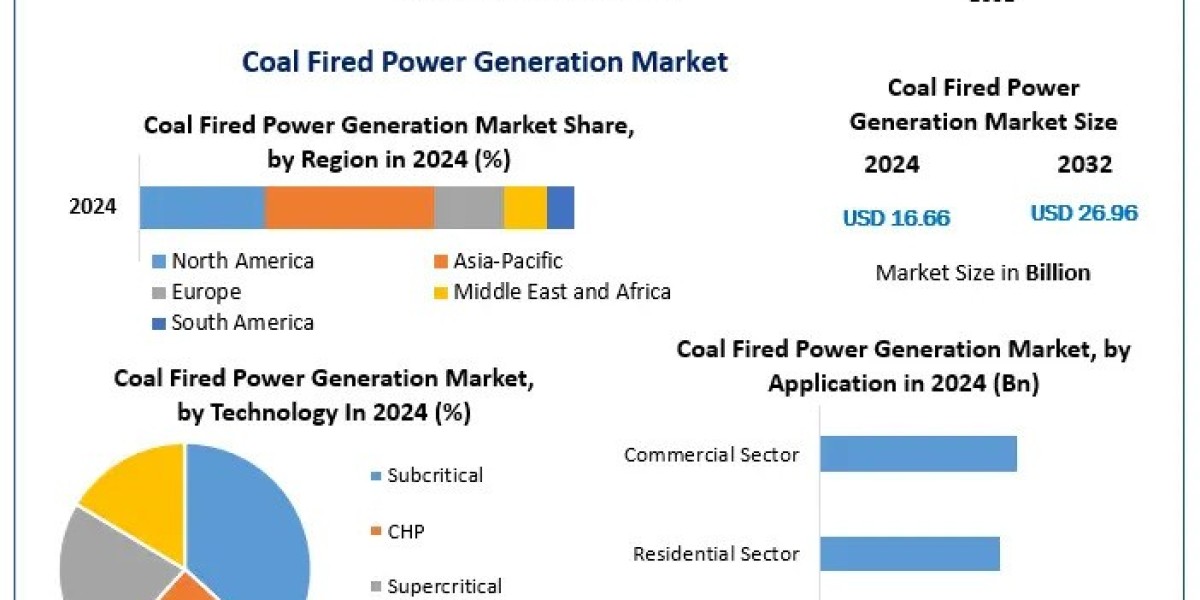

Coal‑Fired Power Generation Market is projected to grow moderately from USD 16.7 billion in 2024 to approximately USD 27 billion by 2032, registering a CAGR of roughly 6.2%, supported by persistent demand in emerging economies alongside slower growth in mature markets.

1. Market Size

- 2024 Market Value: USD 16.7 billion

- 2032 Forecast: USD 27 billion

- CAGR (2025–2032): ~6.2%

Installed capacity reached around 2,220 GW in 2024, and is projected to grow to nearly 2,790 GW by 2033, with a CAGR of ~2–2.5%.

2. Overview

Coal‑fired power remains a cornerstone of global electricity production, primarily through pulverized coal boilers and cyclone furnaces. It offers reliable baseload power—particularly in regions with abundant coal reserves—despite rising concerns about emissions and competition from renewables.

To Know More About This Report Request A Free Sample Copy https://www.maximizemarketresearch.com/request-sample/30048/

3. Market Estimation & Definition

The market encompasses:

- Generation Technologies: Pulverized coal systems (~50%), cyclone furnaces, and fluidized bed or cleaner coal technologies

- Applications: Residential, commercial, industrial, and utility-scale power

- Geographic Scope: North America, Europe, Asia‑Pacific, Latin America, Middle East & Africa

Coal power is classified as baseload generation, valued for stability and cost-effectiveness in many regions.

4. Market Growth Drivers & Opportunities

- Electricity Demand Growth: Emerging markets—especially in Asia‑Pacific—continue to rely on coal as they industrialize and urbanize

- Energy Security: Coal’s widespread availability underpins national energy strategies where renewable infrastructure is still building

- Cost/Economic Advantage: Lower generation costs per MWh and established infrastructure

- Modernization Efforts: Investments in supercritical and ultra-supercritical plants to boost efficiency

- Emerging Technologies: Carbon capture and cleaner coal methods are being piloted

5. Segmentation Analysis

- By Technology:

- Pulverized Coal Systems: Market leader (~50% share); preferred for efficiency

- Cyclone Furnaces: Second-largest with slightly slower growth

- Fluidized Bed/IGCC: Gaining attention as lower‑emission alternatives

- By Application:

- Utility-Scale Plants: Dominant segment

- Industrial Power: Especially in steel, cement, and heavy industries

- Commercial & Residential: Limited, often as captive or backup systems

- By Region:

- Asia‑Pacific: ~55% of market value and capacity; fastest growing

- North America & Europe: Mature with slower capacity growth, though modernization programs are underway

- Latin America & MEA: Smaller but emerging markets for coal power

6. Major Manufacturers & Operators

- China Huaneng Group

- NTPC Ltd.

- American Electric Power

- Duke Energy

- Eskom

- RWE

- Adani Power

- Saudi Electricity Company

- Jindal India Thermal Power

- Dominion Energy

These firms are scaling new ultra‑supercritical projects, retrofitting for emissions control, and investing in coal‑alternative research.

Get More Info: https://www.maximizemarketresearch.com/request-sample/30048/

7. Regional Analysis

- Asia‑Pacific: The hub of coal energy with over 70% of new capacity additions, especially from China and India

- North America: Stable but aging fleet; shifting gradually to cleaner equipment

- Europe: Declining in some countries, but facilities remain for capacity balancing

- Latin America: Growing roles in grid support and industrial development

- Middle East & Africa: Investments for baseload power in countries like South Africa, Egypt, and Saudi Arabia

8. Country‑Level Analysis

- China: Over half of global capacity; new builds surpass retirements

- India: Rapid expansion of industrial plants and national grid support

- United States: Aging fleet with gradual retirements; modernization under way

- European Nations: Germany and UK leading closures; other EU states upgrading remaining plants

- Brazil, SA, Indonesia: Growth tied to industrial expansion and power access in rural areas

9. COVID‑19 Impact Analysis

The pandemic caused transient disruptions in plant operations and supply chains. Stalled energy demand forced delays in new deployments, but coal capacity rebounded strongly as countries aligned stimulus with infrastructure priorities.

10. Competitor (Commutator) Analysis

Market Structure: Major utility and industrial players dominate; small-scale independent power producers are active in niche regions.

Strategic Trends:

- Building advanced supercritical plants

- Exploring carbon capture and storage pilots

- Balancing renewables with coal reliability

- Lifecycle management and retrofits for environmental standards

Challenges:

- Emissions regulations in OECD countries

- Fluctuating coal and carbon credit pricing

- Renewable competitiveness and bank reluctance to fund coal

Opportunities:

- Coal reserve-rich markets in Asia and Africa

- Upgrading ageing plants for higher efficiency

- Integrating power systems with renewables via hybrid projects

- Embedding carbon capture where regulations permit incentives

11. Key Questions Answered

Question | Answer |

Current market value? | ~USD 16.7 B (2024) |

Projected value by 2032? | ~USD 27 B |

Installed capacity? | ~2,220 GW (2024) → ~2,790 GW (2033) |

Key growth region? | Asia‑Pacific |

Leading technology? | Pulverized coal |

Fastest growth tech? | Cleaner coal technology |

Major players? | China Huaneng, NTPC, AEP, Duke Energy, RWE, etc. |

COVID-19 effect? | Brief setbacks followed by infrastructure-driven rebound |

12. Press Release Conclusion

Coal‑fired power generation remains a durable and indispensable component of the global energy mix through 2030. Despite increasing renewable deployment and emissions policies, coal’s reliability, affordability, and adaptability in emerging markets ensure its continued role. With a projected market value nearing USD 27 billion and capacity around 2,800 GW, the sector will evolve through cleaner tech and balanced grid integration. Leading operators focusing on modernization, hybrid systems, and cleaner coal pilots will continue supplying scalable and secure energy as the world transitions.

About Maximize Market Research:

Maximize Market Research is a global market research and consulting company specializing in data-driven insights and strategic analysis. With a team of experienced analysts and industry experts, the company provides comprehensive reports across various sectors, aiding businesses in making informed decisions and achieving sustainable growth.

Contact Us

Maximize Market Research Pvt. Ltd.

2nd Floor, Navale IT Park, Phase 3

Pune-Bangalore Highway, Narhe

Pune, Maharashtra 411041, India

? +91 96073 65656

✉️ sales@maximizemarketresearch.com